Buying your first home - A complete guide

Buying property can be one of the biggest decisions of your life, especially if you are a first time home buyer. Home ownership is the Australian dream. Purchasing your own home is a huge step so make sure you are equipped with all the knowledge needed to make the right decisions. We have put together a comprehensive guide to help with everything from your property search, to property value and property prices through to the property purchase, getting a home loan and everything else in between.

Understanding the property market

Understanding the property market is very important initial step. Research recently sold properties and the median house price in the areas you are considering. Explore what an established property offers compared to house and land packages. You might even attend a few auctions to see how they work.

If the buying location you desire is in high demand, this usually means there are not many houses for sale, which results in higher prices. What you get for your money may be less than you anticipated. When there are plenty of houses for sale and not as many buyers, prices may be lower. You could pay a reasonable price and get great value for money in this market. Talk to your local real estate agent to get an understanding of what is happening in your preferred localities.

Real estate aggregator sites such as realestate.com.au and domain.com.au help you see how many houses are currently available and their price ranges.

Understanding your situation

To narrow your ideas on what your perfect property looks like, ask yourself these questions:

-

What is the purpose of the property?

- Do you just want to get into the property market?

- Are you going to live on the property, or is it an investment property which you will rent out?

- How long do you intend to stay in the property?

- What is your 5 year plan?

- What is your exit plan if your circumstances change?

Lending specialists will ask these questions, so it helps if you’ve already thought them through. The answers may influence the size, quality, location and price tag of your property. They may also influence the structure of your home loan. Your circumstances will also influence whether you wish to have an offset account, or a redraw facility, and whether you opt for a fixed rate home loan, or one with a variable interest rate.

Are your circumstances / family circumstances likely to change?

Your plans for the future, and how long you intend to keep the property, influence what you need in terms of dwelling size, number of bedrooms, bathrooms, and yard size. Because your plans may affect your future capacity to repay the loan, responsible lending specialists need to ensure that your future plans don’t put you in a position of financial hardship if your current circumstances change.

If you wish to start a family, or take time off for full-time study, you might find the security of a fixed interest rate and fixed repayment amounts suits your needs. Alternatively, if you are planning on starting a family, you may wish to pay extra towards your home loan now, so that you can reduce down your repayment amount whilst on parental leave.

Protecting yourself against the unexpected

You never know when something can go wrong. Accidents and injuries, health problems, or unemployment can affect your ability to make your home loan repayments. Personal risk insurances (income protection, trauma, permanent and total disability) can be arranged to replace part of your income should such an event occur. We can refer you to a financial planner to discuss these options. Keeping your new home covered with general insurance is a requirement of your mortgage. We can arrange no obligation comparison quotes by our principle insurer for building and contents insurance.

Seek professional advice with a qualified financial planner to cover all bases. It is never too early to review your current situation and plans for the future. Ensure you are set up to maximise your investments and make the smartest decisions with your money.

Questions to ask real estate agents

How long was the vendor (seller) at the property and why is the vendor selling?

Sometimes vendors need to relocate for work, down-sizing, or up-sizing if they have a growing family. Consider if the vendor's change of circumstances is something that is likely to occur for you in the near future. For example, your need for proximity to schools and workplaces, and the availability of public transport.

Does the property have any issues?

Make sure you obtain your own building and pest report. Consider the age and condition of dividing fences, and isolation pool fencing (if any). Some vendors will make available the last pest inspection they have for the property.

Can I look at a contract?

Whilst your solicitor or conveyancer will assist you with the intricacies of the contract, simple things you can look at, which may affect your ideas about the property, include: flood zoning, zoning of the property itself which may affect your use of it, connections to town water and sewerage, availability of independent water sources (eg bore and tank).

What is included and excluded from the sale?

This should be included in the contract, if available. Ask about particular fixtures you like, as they may not be included with the sale. Sheds, garden furniture and clothes lines may not be fixed to the property. Where NBN is available in the area, it may not be connected to the property.

How long has the property been on the market?

Sometimes properties may be slow to sell if their price is not quite right. Consider whether the price of the property has been reduced over time, and whether it has taken into account the costs of services and rates for the locality.

Can you show me a recent property sales report?

A sales report compares similar properties within an area. It can indicate whether the property is spot on for price, and whether properties are in demand for the area.

Have any offers been made?

This tells you whether you may be competing with other interested parties. It can indicate whether you need to make a higher offer.

What is the minimum price the vendor will consider?

You need to know if your offer will even be considered, before you can consider whether you can afford to increase it. Responsible lenders will gauge your borrowing power for you, so you know where you stand.

Are there development applications before Council?

You should also check this with your local Council before making an offer. Some changes to neighbouring properties can affect your views or increase traffic or noise.

Government incentives to help first home buyers

First Home Owner Grant (FHOG)

The First Home Owner Grant (FHOG) scheme was a government incentive introduced to offset the effect of the GST on home ownership. Under the scheme, a one-off tax-free grant is payable to first home owners who purchase new dwellings or build. Knowing whether you’re entitled to such a grant can boost your deposit significantly. General eligibility requirements include:

- The property must be a brand-new home

- Borrowers are over 18 years of age, are permanent residents or citizens, and have not held a relevant interest in any Australian residential property before 1 July 2000

- The value of the property must not exceed the FHOG (this varies between states and territories)

- You have not received a FHOG in any state or territory, unless subsequently repaid

- You need to live in the home for a continuous period of at least 6 months.

These requirements may be subject to change so check out the guidelines for each state at www.firsthome.gov.au.

First Home Super Saver Scheme

The First home super saver (FHSS) scheme was introduced to reduce pressure on housing affordability. The scheme allows you to save money for your first home inside your superannuation fund by making voluntary concessional (before-tax) and non-concessional (after-tax) contributions into your super fund to save for your first home. This helps you save faster with the concessional tax treatment of superannuation. Consider the full details on eligibility and benefits of the FHSS, learn more at www.ato.gov.au.

Buying property with other people

Buying with a partner

If you are buying your property with someone else you should be aware of the different ways in which the property title can be held, how ownership works and who is responsible for the loan should there be a default, or should one of the parties pass away.

Joint Tenancy

This involves two or more persons holding ownership of the property at the same time. If one party passes away, ownership of the property passes to the survivor. Where the property secures a loan under a mortgage, responsibility for the debt passes to the survivor. Where the parties separate, both parties remain responsible for the loan until it is refinanced into one name, or the property is sold.

Tenants in Common

This titles is often used where the property is for an investment purposes between a number of different parties. Each party owns a proportion of the investment property. The proportion may be equal or divided according to how the property was purchased. For example, two people may own 50% each, or four people may own 25% each, or one person may own 30% and the other two parties 35% each. It depends on how the purchasers wish to apportion ownership.

Where the property title is taken as security for lending, all persons on the property title are equally responsible for the loan. This means that even if your investment partner who owns 70% of the title is defaulting on the loan, you remain equally responsible for paying off the entire debt.

Tenants in common titles allow people to jointly invest in property, but in the case of death, the property doesn’t automatically pass to the other parties. As to ‘who gets it’? this is specified in your Will. Discuss any concerns with your legal advisors.

Hidden costs of buying property

A property’s price tag is not the only cost to consider when buying your first home. There are additional costs that make up the full purchase price:

- Property inspections (building and pest) costs: it is highly recommended that you have these standard checks carried out by licenced inspectors to ensure the property is structurally sound and pest-free. These are upfront costs which you will not recoup if you do not purchase the property. These inspections are vital when buying and established home.

- Loan application fee: a fee to process your application. Ask what it covers, as valuations are often excluded.

- Property valuation fee: a valuation report is required by responsible lenders to evidence that the value of the property is sufficient to support the amount being borrowed.

- Solicitor/conveyancer fees: these costs relate to licenced individuals carrying out any legal work involved with purchasing your property. This includes obtaining searches from government bodies and third parties which tell you of certain issues with the property. Your solicitor or conveyancer can advise on the searches that are appropriate for your property. For example, a land tax certificate is relevant for all properties, whereas a strata search is only applicable to apartments.

- General insurance and rates: as owner of a property subject to a mortgage, you have an obligation to insure the property, and to keep council rates paid up to date, and pay strata fees if you are moving into an apartment.

- Stamp duty: this state tax is payable when transferring ownership of a property. The percentage varies between states. In some cases First Home Buyers are exempt. See guidelines for each state: www.firsthome.gov.au.

- Mortgage registration fee: your state registry responsible for maintaining the records of property ownership imposes an administrative fee for registering a change of property ownership and for noting the mortgage against the property.

- Utility connection costs: providers of electricity, gas and telecommunications often impose a connection fee for your new property, and a disconnection fee for your former home.

- Moving costs: factor in removalists, and postal redirection.

These costs can add thousands of dollars on top of the property's purchase price.

Borrowing money to purchase your new home

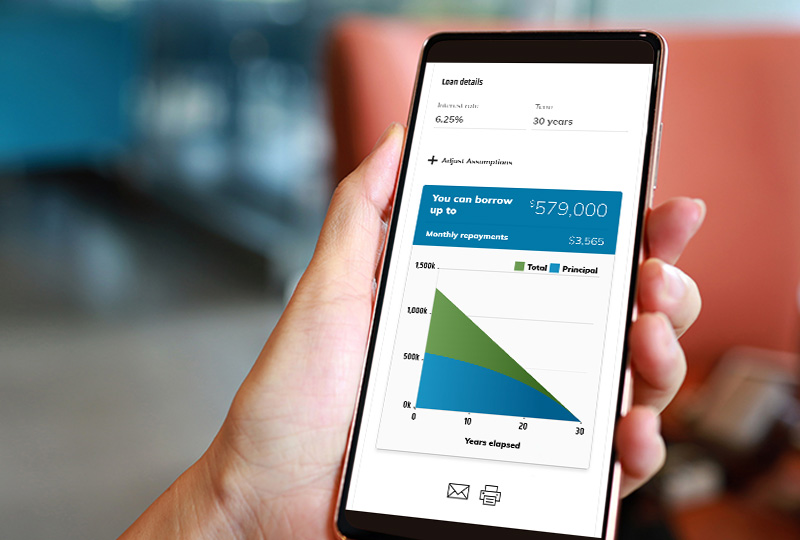

Borrowing power is based on your current financial circumstances including your current income, expenses, assets and debt, plus the amount you have saved for a deposit. Your borrowing power is determined by your ability to make the mortgage repayments comfortably, calculate what you can borrow with our borrowing power calculator.

Can I get pre-approval?

Pre-approval gives you a good understanding of the amount you may be able to borrow, based on your current financial status, and subject to certain conditions. It's a good starting point which allows you to house-hunt. Often real estate agents will ask for evidence of your borrowing power, and Northern Inland provides you with a letter which is good for 90 days provided your circumstances do not change.

Do I need a deposit?

A deposit of 20% of the purchase price plus enough to cover ongoing costs is ideal. Some contracts of sale may specify a different amount. The bigger your deposit, the lower your loan to value ratio (LVR) will be. This is the amount of the loan divided by the purchase price (or appraised value) of the property.

Most lenders will accept a 10% deposit or even a 5% deposit of the purchase price. A lower deposit will increase your mortgage repayments and you'll have to pay lenders mortgage insurance for deposits less than 20%.

Paying lenders mortgage insurance

If you have a 20% deposit or greater (LVR of 80% or less), you will avoid paying Lenders Mortgage Insurance (LMI). If your deposit is less than 20% of the property purchase price then you will have to pay LMI. This protects the lender, not the borrower.

By establishing good savings habits, not only can you save your deposit faster, but it shows lending specialists that you know how to budget and plan for the future. Set up a dedicated interest-bearing account so that you can make regular deposits each time you get paid. Northern Inland can help you automate this payment.

First Home Guarantee (FHBG)

FHBG (formerly known as First Home Loan Deposit Scheme) is a government initiative designed to help low and middle income earners enter the property market. Under the scheme an eligible home buyer can buy a home with as little as a 5% deposit and not have to pay LMI because the Australian Government guarantees up to 15% of the value of the property, for more information see www.nhfic.gov.au.

What is a guarantor loan?

If you do not have a 20% deposit you can have a parent or family member become a guarantor for your loan and you won't have to pay LMI. The guarantor needs to have a home loan with sufficient equity to be your guarantor. If the borrower defaults on their loan repayments it can fall on the guarantor to take over the repayments. Legal advice before providing a guarantee is strongly recommended.

What does a mortgage broker do?

Generally you have two options when buying your new house. You can take out a home loan directly through a credit union or bank, or you can go through a mortgage broker. A mortgage broker is essentially a middleman who will provide you with home loan options from multiple credit unions or banks and refer you to the one you choose. Mortgage brokers are paid by the credit union or bank if a referral leads to a home loan.

The borrower’s relationship with the mortgage broker generally ends after a decision is made.

Choosing a home loan

Like any product, home loans come in all shapes and sizes. The right one for you will depend on a range of factors and eligibility criteria including whether you want the certainty of a fixed interest rate, or the flexibility of a variable interest rate where you can pay extra toward your loan, and how you like to access your savings and make transactions generally.

- Fixed interest rates: a fixed rate home loan has the interest rate locked in for a specific period of time, usually 1 to 5 years. As your interest rate doesn’t change during your set period, your repayments remain the same, which can be handy for budgeting. If interest rates increase, your loan and its repayments are not affected. If interest rates drop however, you miss out on paying less interest. There can also be expensive break costs and limits on extra repayments to take into consideration.

- Variable interest rates: a variable interest rate loan can increase or decrease during the course of your mortgage. Accordingly, your required repayment amounts could increase: responsible lenders will give you advance warning in writing if this applies to your loan. Before committing to a variable rate home loan it’s worth thinking about whether you can maintain the repayments if the interest rate increases significantly. Responsible lenders factor in some level of increase when assessing your credit application.

- Interest only: a method of temporarily reducing your repayments is opting for an interest only loan, which requires payment of only the loan interest each month, and no repayment of principal, for a set period. This is often used for homes being constructed, up until the time you are able to move in. Interest-only loans are not a long term option.

For an in-depth comparison of fixed and variable loans see our fixed vs variable interest home loans article.

Extra repayments and redraw facility

Loans with a fixed interest rate have limitations on the amount of extra repayments you can make during the fixed rate period, whereas variable rate loans often allow extra funds to be paid at any time. Where the calculation of your interest is made daily on a variable interest rate loan, there are interest rate savings if you can pay extra. A redraw facility means that you can access those extra funds you have paid to your loan, above what is required under your loan contract. This can be helpful if you have unexpected expenses, like the need to replace white goods, or vehicle repairs.

Added extras

Loan types range from basic loans with a low rate and no extras, through to full packages with additional benefits such as offset accounts, waiving of fees, discounts on other products, rebates on transaction fees or even cash back promotions. It is important to weigh up the true, cost compared with your needs. How you like to access your funds and make your payments often dictates whether the added extras will be of benefit to you:

- Mortgage Off-set accounts: work to reduce the amount of loan interest you pay. If you are a disciplined saver and spender, then leaving all your available funds in your Offset account can make a big difference to the loan interest that you have to pay.

- Discounted rates on credit cards: Northern Inland offers a discounted rate on your Northern Inland Credit Card which applies for the life of your home loan. If you are disciplined in your credit card use, save even more on your home loan interest by paying your bills on your credit card, then paying your credit card balance in full each month from your loan offset account.

- Fee-free transaction methods: Northern Inland provides free online banking, mobile app transactions. If you can limit your need for cash, cheques and over the counter services, you can transact fee-free.

- Flexible repayments: Northern Inland lets you select to make weekly, fortnightly or monthly repayments, and automates the payment to tie in with your pay day.

Comparison rates

This is an indicative interest rate that is designed to help you compare loan accounts. It includes the loan interest rate, and any fees that are known at the time the loan is being accepted, such as establishment fees, and monthly account keeping fees, to express the true cost of a loan into a single rate, over a 25-year term. It does not include fees that are contingent on a future event that is not discernible at the time a loan account is established, such as costs associated with redraw, progress payments or early repayments. Government and statutory charges are also excluded.

The 8 step home buying process

Buying a home is an exciting time, it can be overwhelming for first home buyers, our lending specialists are here to help you.

Step 1 - Home loan application

Gather evidence of your income, details of your assets (what you already own, such as your last superannuation statement), your debts and expenses. Generally, lenders will require:

- 3 recent payslips or your last two tax returns if you are self employed

- Quarterly rates notice or rent receipt, depending on whether you already own a home or you rent

- Evidence of any other income, such as Centrelink letters

- Credit and store card statements

- 6 months’ worth of bank account and loan account statements, and any Buy Now Pay Later arrangements you have in place.

Step 2 - Assessment

We’ll need to verify your identity, income and carry out a credit check. If you are already a Northern Inland Member we’ll already have a lot of this information.

Step 3 - Pre-approval (or conditional approval)

Providing you have given us all the required supporting documents, we can provide you with a measure of your borrowing power, often within 24 hours. We provide a pre-approval letter which outlines the amount which you have been approved to borrow in principle, providing there is no change to your circumstances in the next 90 days, and subject to your chosen property meeting certain conditions. From here you can house hunt with confidence!

Step 4 - House hunting

Open houses here we come! Get excited and take your time to find the one that suits you and your needs.

Step 5 - Make an offer

Liaise with the real estate agent to make an offer on the property.

Step 6 - Inspections and reports

When you find the right property, let us know so we can assist you to obtain a valuation. Your solicitor/conveyancer can often help recommending providers of pest and building inspections.

Step 7 - Exchange of contracts

Loan contracts are exchanged with the assistance of your solicitor/conveyancer, and your deposit is paid. Additional searches and certificates are generally ordered at this time.

There may be a cooling off period where the buyer may change their mind about the purchase even after the contracts have been signed and exchanged, this varies from state to state.

Step 8 - Settlement

The settlement period is usually 6 weeks after the contracts have exchanged, with the final day referred to as the 'settlement date'. This is the final step in the property buying process – the loan is funded and keys provided to the proud new owners. Time to celebrate!

This article is general in nature and does not constitute personal advice. Consider your circumstances and read terms and conditions before making a decision on whether a product suits your needs.

Speak with a Northern Inland home lending specialist for help with buying your first property, contact us.