Security

We take the protection and security of your information, transaction data and privacy seriously. We will never ask for your password or account details to be disclosed via a link within an email message. If you receive such an email, please delete it and contact us immediately on 02 6763 5111 or send us a secure email via the 'Inbox' after logging into Online Banking.

Our commitment to your security and privacy

We use a wide range of security measures to help protect your personal information and transactions, including data encryption, firewalls and automatic timeouts. We use a fraud monitoring system to protect you from possible unauthorised transactions on your account through Visa, Mobile Banking and Online Banking. If you have a current mobile phone number and we need to confirm a transaction with you, you will receive an SMS to contact us to verify the transaction.

Your security, we all play a part

Online security is a partnership between us (as the provider of online banking services to you) and you (the user of these services). As such, it's important that you do three things:

- Stay informed

- Improve your own online security

- Monitor your transactions and quickly contact us on anything unusual or unauthorised. You can view your transactions at any time using Online Banking.

Keeping informed

Register for the Australian Governments Stay Smart Online Alert Service to explain recent online threats and how they can be managed.

Online Banking, our internet banking service, provides users with the following security:

- Firewalls

- Encryption

- Automatic Time-outs

- Second Factor Authentication at login on request

- Incorrect Password Access Lock

- Last Login Time Check

Improving your online security

You can play your part in protecting your information responsibly and in accordance with our terms and conditions.

- Do not disclose passwords, PINs or login details to any person. Under no circumstance would Northern Inland ask a Member to disclose their account details or login PIN/Password by any means including email or telephone. We will not make unsolicited requests for this type of Member information. We use special questions to identify you if we speak to you over the phone.

- Always login directly from the homepage of nicu.com.au

- Never access Online Banking within an email link and disregard emails that request you to do this.

- Delete suspicious emails without opening them. Avoid opening dubious attachments, even if the email seems to come from someone you trust and never click on any hyperlink in an email. Phone us if you are uncertain.

- Change your PIN and/or Password regularly, and protect your personal information by keeping it confidential. Do not share it with anyone, including family and friends.

- Avoid using computers in public places, such as internet cafes, to undertake any Online Banking functions. Check that nobody is looking over your shoulder and keep private information out of chat rooms or email.

- Look for the "Closed Padlock" symbol at the bottom or top right corner of your web browser

- When using Online Banking; look for "https://" in the address bar

- Keep your computer secure by installing effective virus programs and firewall protection. Don’t leave your computer while you are logged on to Online Banking, and always remember to logout from Online Banking.

- If you have any concerns about your account contact us on 02 6763 5111

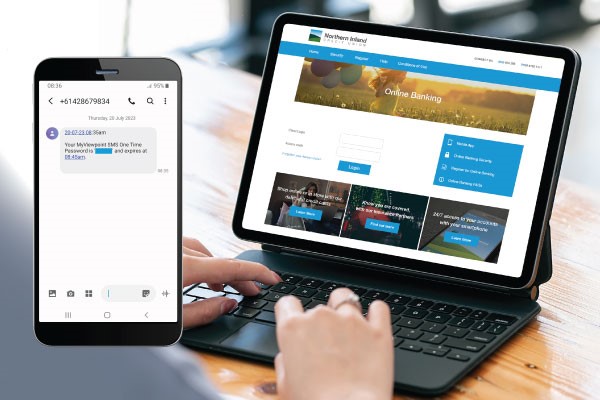

2 Factor Authentication (2FA)

Two Factor Authentication (2FA) enhances the security of your account by adding an additional layer of protection. It helps prevent unauthorised access even if someone gets hold of your password.

Northern Inland Credit Union uses an SMS One-time Password as a 2FA security measure for Online Banking.

Set up 2FA in 4 easy steps

- Log in to online banking

- Select Member services in the blue menu at top of page

- Select Set up security options in the drop down menu

- Select SMS one time password to activate

How does 2FA work once I have registered?

Once registered for 2FA Log in to Online Banking using your Client Login and Access Code.

- A SMS one time password will be sent to your nominated mobile phone

- Your Online Banking message will read an SMS one time password has been sent to your mobile number

- In the Enter One Time Password text box, enter the 6 digit password that has been sent to your mobile phone, then select OK

Notes: The mobile number used for 2FA is the one linked to your account.

Do I need to setup 2FA for the smartPay App?

You need to set up 2FA to keep using Online Banking and the smartPay App. Set up is only required in Online Banking, no actions are required within the app.

Additional benefits of 2FA

In addition to the increased layer of security, you need 2FA to enable:

- OSKO payments

- External Funds Transfer limit greater than $1,000

- BPAY Payments limit greater than $3,000

- Allows you to change your card PIN within the smartPay App